arizona estate tax exemption 2020

If such an election was made her husband would then be able to leave 8000000 estate tax-free by using his own exemption of 5000000 plus his deceased wifes unused exemption of 3000000. Because Arizona conforms to the federal law there is no longer an estate tax in Arizona after January 2005.

Arizona Estate Tax Everything You Need To Know Smartasset

Leave a Reply Cancel reply.

. The lifetime gift tax exemption for gifts made during 2020 is 11580000 increased from 114 million in 2019. Ad Download Or Email AZ ADEQ More Fillable Forms Register and Subscribe Now. If you are a tax agent an agency authorization form is required when requesting the duplicate form.

In 2020 it set at 11580000. The federal estate tax exemption is 1170 million for 2021 and increases to 1206 million for 2022. As of 2020 the ID legislator approved property tax.

This exemption rate is subject to change due to inflation. The Internal Revenue Service announced today the official estate and gift tax limits for 2020. The estate and gift tax exemption is 1158 million per.

Residents and nonresidents owning property there can rejoice. Federal law eliminated the state death tax credit effective January 1 2005. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

While there is no Arizona inheritance tax law you may or may not be exempt from an inheritance tax based on the federal law. Up until 2008 transfer taxes were charged in Arizona and were often paid by the home seller. Your email address will.

31 2020 may be subject to an estate tax with an applicable exclusion amount of 11580000 increased from 114 million in 2019. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Final individual federal and state income tax returns each due by tax day of the year following the individuals death.

1 2022 Arizonas homestead exemption will increase from 150000 to 250000. Fax your request to 602 506-7335 or email Asr-bpp-pubasstmaricopagov. Homestead exemption increase As of Jan.

The estate tax exemption was then increased in 200000 increments to reach 3 million in 2020. Therefore Connecticut estate tax is due from a decedents estate if the Connecticut taxable estate is more than 51 million. The ballot measure would have consolidated the Arizona Constitutions provisions that address property tax exemption into a single section.

During the tax year the taxpayer paid more than 800 for either Arizona home health care or. There are no inheritance taxes or estate taxes in Arizona. The 2021 standard deduction is 12550 for single taxpayers or married filing separately.

25100 for married couples. All estates in the United States that are worth more than 549 million as of 2017 are required to pay an estate tax. Duplicate forms may be sent as an email attachment faxed or mailed.

The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. The federal inheritance tax exemption changes from time to time. Ad From Fisher Investments 40 years managing money and helping thousands of families.

Although many states impose taxes on lifetime gifts or at-death transfers Arizona does not. The current federal estate tax is currently around 40. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023.

But that doesnt leave you exempt from a number of other necessary tax filings like the following. This means that homeowners can protect more of the equity in their homes. The Arizona Constitutional Property Tax Exemptions Amendment was not on the ballot in Arizona as a legislatively referred constitutional amendment on November 3 2020.

During the tax year the taxpayer paid more than one-fourth of the cost of keeping this person in an Arizona nursing care institution an Arizona residential care institution or an Arizona assisted living facility. Generally a person dying between Jan. The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020.

Ad Register and Subscribe Now to Work on AZ ADEQ More Fillable Forms. Starting in 2022 the exclusion amount will increase annually based on. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Even though Arizona does not have its own estate tax the federal government still imposes its own tax. The cost must be more than 800. Because Arizona conforms to the federal law there is.

The top marginal rate remains 40 percent. Arizona offers a standard and itemized deduction for taxpayers. A federal estate tax return can be filed using Form 706.

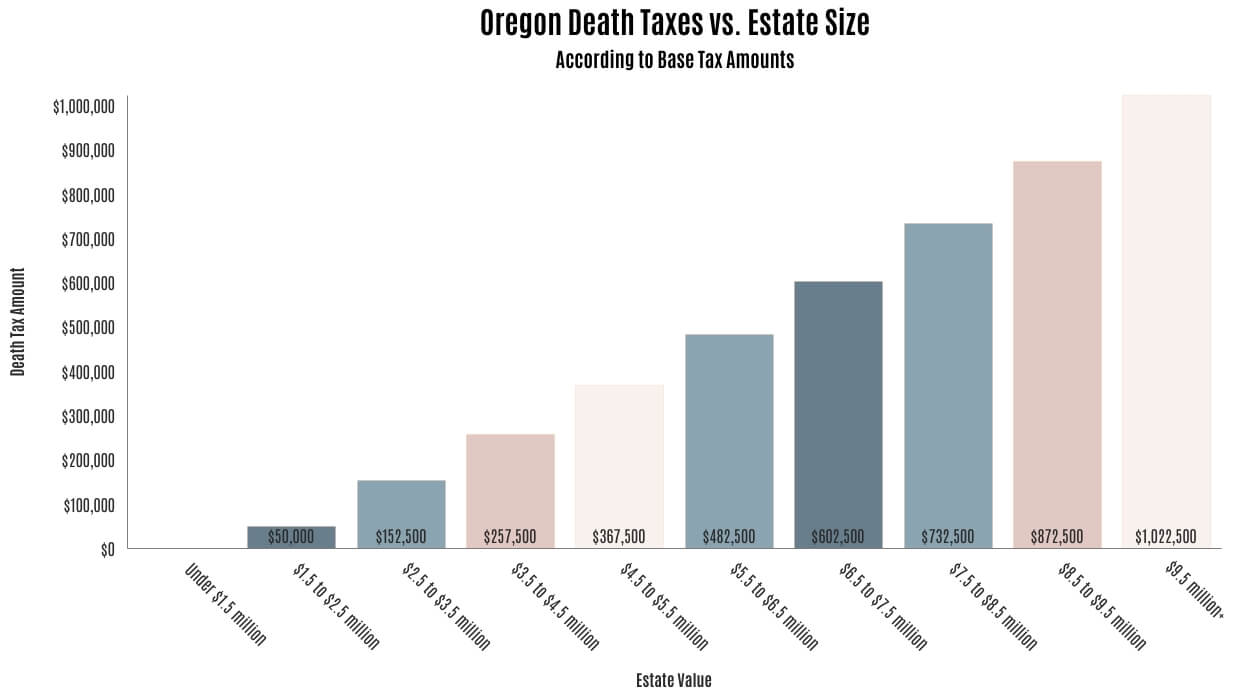

The estate tax rate was adjusted so that the first dollars are taxed at a 9 rate which ultimately maxes out at 16. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return.

What Is Inheritance Tax And Who Pays It Credit Karma Tax

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Is Your Inheritance Considered Taxable Income H R Block

How To Avoid Estate Taxes With A Trust

The State Of The Inheritance Tax In New Jersey The Cpa Journal

State Death Tax Hikes Loom Where Not To Die In 2021

Arizona Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Even With No Estate Tax Some Tax May Be Due On Inheritance Fleming Curti Plc

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Estate Tax Planning In Arizona Gilbert Az Estate Planning Law Firm

Eight Things You Need To Know About The Death Tax Before You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Avoid Estate Taxes With A Trust

Irs Announces Higher Estate And Gift Tax Limits For 2020

Arizona Estate Tax Everything You Need To Know Smartasset